Chris Hall of Flood Flash on the growing movement within the Insurance Industry towards rewarding insurers who invest in measures to increase their Property Flood Resilience (PFR).

Chris Hall joins the exciting programme of speakers delivering our PFR workshop programme for Construction businesses, starting 7 December 2021.

Investing in flood resilience measures can be expensive. Very expensive. Installing flood gates across a property can cost thousands upon thousands of pounds. After the flood gates, you need the air bricks. After the air bricks, you need the non-reverse valves. Then the brick treatment, window replacements and pump installations. Making a property resistant (keeping a flood out) can cost serious money, and that’s before you go into the building to make it more resilient (easier to recover from a flood) by reflooring or changing the height of electrical sockets.

Investing in flood resilience measures can be expensive. Very expensive. Installing flood gates across a property can cost thousands upon thousands of pounds. After the flood gates, you need the air bricks. After the air bricks, you need the non-reverse valves. Then the brick treatment, window replacements and pump installations. Making a property resistant (keeping a flood out) can cost serious money, and that’s before you go into the building to make it more resilient (easier to recover from a flood) by reflooring or changing the height of electrical sockets.

These measures are designed to make sure that the property owner avoids costs later on when floods hit. But, it can be tricky to justify the prices when there are often more immediate risks that demand the money instead.

Large scale resilience measures can provide great protection for a home or business. The biggest challenge is often not identifying the measures but balancing the potential savings with the installation and maintenance costs.

It stands to reason that if you invest in measures that help prevent or mitigate flood costs at your property, you will be rewarded by your insurer lowering your premium. An immediate saving could tip the scales in favour of resilience investment and many insurance companies are now encouraging clients to ‘build back better’ by installing new resilience measures as part of repairs following a flood event.

This has not been the case historically though, and premiums rarely change, even with significant risk reductions. This article explores the rocky relationship between flood resilience measures and insurance premiums and shows how new insurance methods could be the answer in making the logic of higher investment and lower costs a reality.

How resilience measures can reduce your exposure to costs

Spending thousands of pounds on flood resistance and resilience measures reduces your costs when a smaller flood occurs. Traditional indemnity insurance policies rarely reward this investment though. The reason? The “indemnity” part of the insurance.

Indemnity insurance is based on the principle of recouping your losses exactly (with exclusions and restrictions). These policies often use a value known as the “Buildings Declared Value” (BDV), also known as the “sum insured”. BDV establishes the maximum amount you would need to reinstate the property in full. If your policy covers multiple risks your BDV may apply to all of them. The value is designed to cover rebuilding and furnishing a building from scratch. Imagine the maximum amount you’d need after a claim, for example after it has burned down, been destroyed by subsidence, or a flood has washed the building away.

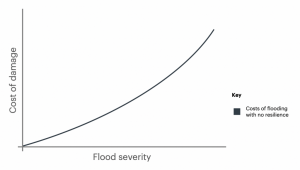

BDV is also the maximum cost that you pose to your insurer. Allowing for sub limits and other exclusions it is the most they would ever pay you after a claim. A small flood may only cost you, and by extension your insurer, a limited amount. It’s possible to plot a curve demonstrating how an increase in the severity of the event and claim will increase your costs, leading all the way up to the BDV.

typical curve showing how a more severe flood will cause higher costs, approaching the BDV. Extra credit: Many people in the risk and insurance world agree that a typical flood risk curve like this probably doesn’t max out at the BDV. Flooding isn’t likely to cause the maximum possible damage. For example, if the property is made of concrete, then you aren’t going to have to rebuild after a flood.

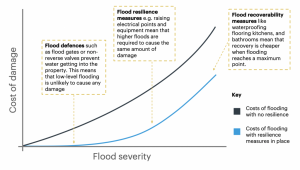

Implementing flood resilience measures that defend you from costs up to a certain level changes the shape of the curve. Imagine a business implements measures that mean a flood of 0.6m only requires implementation of a flood plan and a small clean-up effort. Their curve might look a little more like this:

Now compare the cost of damage when the business implements flood resilience measures. The gap between the black and blue lines represented the reduction in costs when a flood happens.

In this instance, the area between the two lines represents the reduction in exposure that a business benefits from as a result of installing resilience measures. Why then do insurers not reward this reduction with cheaper premiums?

Why traditional insurance struggles to reward investing in resilience

The reason traditional indemnity insurers rarely give a discount to their customers after resilience measures have been installed is simple. Whilst the traditional insurance community has access to the highest resolution flood models, they cannot map this to the costs that these floods may cause. To make matters even more difficult, the resilience movement is still new, so the impact resilience has on costs has not been established. It is therefore near impossible to accurately estimate the correct reduction in premium based on removing low cost claims for lower severity floods.

Add to that the fact that they are still concerned with the BDV and the case for keeping premiums higher becomes clear. Whatever happens, there is still a sliding scale from a minimum amount of damage to the maximum pay-out possible. The range of possible outcomes is still the same from a cost perspective.

Other factors also contribute to traditional insurers being reluctant to offer premium reductions:

- They may not trust that the resilience measures are installed/maintained properly

- They do not rely on the human element of resilience measures, such as when flood gates need to be put up, or pumps turned on

- They are upholding a historical relationship that included flood. They may not have the correct risk data for the property, but they don’t remove cover because they don’t want to lose the primary insurance.

How parametric insurance rewards resilience

It is frustrating that insurers are slow to reward their clients that take risk more seriously. There are changes happening though, the biggest of which comes in the form of parametric insurance. It may sound complicated, but it’s simply cover that pays a pre-agreed sum of money if a certain event happens. If a parameter (hence “parametric”) can be measured, then it can be covered by a parametric policy.

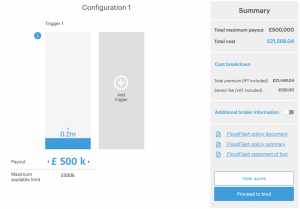

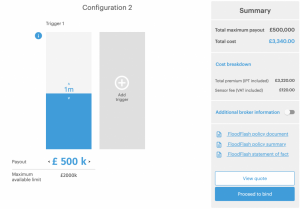

In the case of flood insurance, the obvious parameter is flood depth. At FloodFlash, we provide cover that is attached to “trigger” flood depths. Clients choose trigger depths that they would need money for, and when a flood reaches that depth, they receive a pre-agreed payout.

Parametric insurance covering 3 depths: the range of costs is limited based on decisions around resilience. As a result, the premium can be much more affordable.

This new form of insurance is beginning to show that mitigating risk can pay off. By choosing a higher flood depth for their cover, a client benefits from a cheaper premium. The client is in complete control of when they receive a pay-out. If a client is confident that they are flood resilient up to a depth of 0.6m (a decent sized flood door) then they can design their cover so it kicks in when a flood breaches the resilience measures. In the example below, the client has chosen to receive a pay-out at 3 depths: 0.6m, 1.0m and 1.5m. They receive a pay-out at each of these depths, but BDV is out of the equation – so the insurer no longer has the uncertainty of where on the line the cost will land.

In this example the cost of a given flood is now limited to the three different trigger scenarios. Less uncertainty for the insurer means that premiums can come down and reflect the level of resilience that a business has achieved.

The drawbacks of parametric cover – and how to overcome them

The client takes on the risk of when resilience measures aren’t installed correctly: this is the inverse of why indemnity insurers may not lower their premiums. The best way to get around this is to get a guarantee from the resilience providers.

Clients don’t recoup the exact amount reflecting their damage: The trigger depths and pay-outs are distinct values so pay-outs is not based on exact damages. Parametric insurance is all about making sure a client has enough, rather than exact amounts. Using multiple trigger depths can help mitigate this and ensure that clients have enough money to recover from different severities of flooding.

Extra credit: whilst the concept of BDV might make it seem like a property is fully covered in any scenario there are pitfalls. The concept of “averages” allows traditional indemnity insurers to double-check that the BDV was calculated correctly at claim. If the BDV was too high compared to the value of the insured property, they can reduce the value of the claim. This leaves customers feeling short- changed and shows the dangers of applying for more cover that you need.

Using parametric insurance quotes to make a case for resilience

Clients can design parametric cover to suit their resilience levels. Creating two Flood Flash policies with different trigger depths can produce very different premiums. The difference in annual premium can even amount to the investment needed to install flood defences.

In this example we imagine the client is considering resilience measures to a height of 100cm. Changing the lowest trigger from 20cm to 100cm nets them a saving of over £18,000 per year – setting their budget for the investment.

To help Construction SMEs understand the opportunities in the field of Property Flood Resilience, the Flood Innovation Centre is delivering a five-week PFR workshop programme from 7 December 2021. The online, interactive workshops are aimed at SMEs working across all construction phases from planning and design through to build and maintenance. In order to access the fully-funded (free to your business) workshop series, please visit https://floodinnovation.co.uk to register.